Indonesia’s government has been forced to dip into the state budget, something it said it wouldn’t do, to pay for cost overruns on China’s signature Jakarta-Bandung fast-rail project, which continues to be dogged by construction delays and land acquisition issues.

Indonesia’s government has been forced to dip into the state budget, something it said it wouldn’t do, to pay for cost overruns on China’s signature Jakarta-Bandung fast-rail project, which continues to be dogged by construction delays and land acquisition issues.

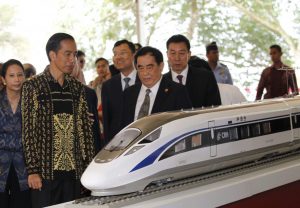

Launched in 2015 in the second year of President Joko Widodo’s presidency, the price tag for the 143-kilometer rail link has ballooned from US$6.07 billion to more than $8 billion with a completion date now set for late 2022, two years behind schedule.

Funded with a $4.5 billion Chinese loan, the project falls under Beijing’s Belt and Road Initiative (BRI) which a new detailed report by the AidData research unit at Virginia’s William & Mary College says has left Indonesia and many other countries saddled with a mountain of often unreported debt.

A comprehensive spreadsheet accompanying the AidData report shows that China committed more than $34.9 billion in financial aid to Indonesia between 2000 and 2017, designated as either official development assistance (ODA) or other official flows (OOF).

The researchers say Indonesia has $4.95 billion of sovereign debt exposure to China and $17.28 billion in what they call “hidden” public debt, which has been incurred by state-owned companies or other government entities without sovereign guarantees.

That means fully 78% of Indonesia’s debt to China is off the government’s books, amassing what a Koran Tempo newspaper editorial has ominously described as a “ticking time bomb” that could impact the country’s future economic development.

China’s weighted average borrowing terms, according to AidData team leader Brad Parks, are a 4.06% interest rate, a 15-year length of maturity and a 2.7-year grace period. The railway loan carries a 2% interest rate to be paid over 10 years.

By comparison, an Organization for Economic Cooperation and Development (OECD) study shows that ODA loans by all OECD members average out at an interest rate of 1.1%, with a maturity period of 28 years.

Analysts note that about half of the Chinese-funded projects have a “round trip” element under which the money being lent goes back to China through contract payments to Chinese or mixed Chinese-Indonesian entities, many of which use imported Chinese labor.

A new presidential regulation permits the use of the budget to finance the rail project, either through a loan guarantee or a capital injection. “Like it or not, but we have to ask the government to participate in funding the project if we want it to be finished on time,” said a State Enterprise (SOE) Ministry spokesman.

Although Japan had spent two years conducting a feasibility study, China won the rail contract, not only with a clear financial inducement but also by dropping its demand for a sovereign risk guarantee.

“It’s the definition of a train wreck,” says one Jakarta-based business source familiar with the early beginnings of the project. “It wasn’t a good idea from the start because the route is too short for a fast rail unless it is planned to go all the way to Surabaya.”

Indonesia has a 60% stake in the PT Kereta Api Indonesia (KCIC) joint venture, comprising local partner PT Pilar Sinergo BUMN Indonesia (PSBI) and a Chinese consortium made up of China Railways International Co Ltd and four other companies.

Falling under the PSBI umbrella are four state enterprises, namely construction firm PT Wijaya Karta Tbk (38%), rail company PT Kereta Api Indonesia (25%), plantation owner PT Perkebunan Nusantara VIII (25%) and tollway operator PT Jasa Marga (12%).

Last month, in a sign of mounting financial problems, Wijaya Karta (WIKA) handed over its leadership role to Kereta Api (KAI), with the government injecting an additional $286.7 million into the venture from the 2022 State Budget.

KCIC officials said the funds would be specifically used to cover cost overruns caused by land purchases and the relocation of social and public facilities, such as electricity substations, water mains and fiber optic cables that were not foreseen during the planning stages.

But analysts find that difficult to understand when buying land, in particular, is often a major obstacle to public infrastructure projects, especially when it is outside the right-of-way and doesn’t qualify as eminent domain under the country’s 2012 Property Law.

The SOE ministry spokesman added to that litany of problems, blaming over-optimistic planning and poor management – and finally Covid-19, which he said had shrunk the budgets of other state construction companies involved in the project.

Officials are waiting for the Development Finance Comptroller (BPKP) to complete an audit of the project to determine how much the government will have to pay to save the rail link, which is designed to cut the current three-hour trip to 45 minutes.

Maritime Affairs and Investment Coordinating Minister Luhut Panjaitan will head a newly-formed committee comprising Finance Minister Sri Mulyani Indrawati, SOE Minister Erick Thohir and Transport Minister Budi Karya Sumadi to restructure PSBI.

Although the project is now 78% complete, three of the 13 tunnels still need to be completed and contractors are faced with engineering and environmental problems that could continue to cause serious delays.

Critics worry that the intervention will become a bad precedent for state companies, already notorious for inefficiency and corruption, which have played a key role in many recent infrastructure projects because they dispense with the tedious tendering process.

Those who question the economic viability of many BRI projects, including the $6 billion, 417-kilometer fast-railway across Laos, say it will take decades to recover the cost of the Jakarta-Bandung venture because of the short distance and four scheduled stops.

The link is planned to carry 32,000 passengers a day, but there are already concerns that commuters will prefer using the tollway or stick to the normal train service, which costs 90,000 rupiah for a one-way trip, less than a third of a projected fast-rail ticket.

The brainchild of the Japan International Cooperation Agency (JICA), the project was originally approved by then-president Susilo Bambang Yudhoyono, with JICA agreeing to bankroll 75% of the project at a 0.1% interest rate as long as the government provided a loan repayment guarantee.

When Widodo took office, his first instinct was to cancel the railway to avoid the growing competition between Japan and China. But then he went back on what one business source called the “perfect solution” and settled on the bigger of the two economic powers.

China’s forceful intervention came with the promise of a cheaper project price, an earlier completion date and a superior level of liability, including the absence of a sovereign guarantee, something the more prudent Japanese would not agree to.

AidData points to a curious aspect of the role of the China Development Bank (CDB), whose loan portfolio has become substantially more concessional during the BRI era, despite Beijing’s assertion that it is a commercial bank adhering to commercial practices.

Although it usually lends at a floating market interest rate, AidData says the sharp increase in CDB loan concessions stemmed from the bank deviating from its own loan pricing guidelines specifically for the “strategically-important” Jakarta-Bandung project.

Interestingly, Indonesia joined the BRI in March 2015, at the same time China gave Indonesia a $50 billion general loan package, which was subsequently distributed in two tranches.

A month later, at the 60th Asia-Africa conference in Bandung, Widodo called on third world countries not to become dependent on international lending institutions such as the International Monetary Fund (IMF) and the World Bank (WB). The prospect of dependency on China did not arise at that time.

William & Mary is a public research university whose current chancellor is Robert Gates, a Central Intelligence Agency (CIA) veteran and former secretary of defense in the George W Bush and Barack Obama administrations from 2006 to 2011.

Overall, the AidData report captures 13,427 projects worth $843 billion across 165 countries over an 18-year period, basing its designation of ODA and OOF on the concessionary level of finance provided and whether the intent of the project is development or commercial.

Since the launching of BRI in 2013, it notes that China has maintained a 31 to 1 ratio of loans to grants and a 9 to 1 ratio of OOF to ODA, with state-owned banks organizing syndicates and other co-financing deals that make it possible to undertake big-ticket infrastructure projects.

Using open-sourcing, the researchers assess that 35% of the BRI infrastructure project portfolio, involving 140 countries, has encountered major implementation problems, such as corruption scandals, labor violations, environmental damage and public protests.

The report finds that Chinese debt burdens are substantially higher than previously understood, which conceivably allows Beijing to extract political and economic trade-offs.

Indonesia is fourth on the ODA list at $4.42 billion, behind Iraq, North Korea and Ethiopia, and sixth among the OOF countries at $29.96 billion, consisting mainly of loans and export credits priced at close to market rates. In that category, it trails Russia, Venezuela, Angola, Brazil and Kazakhstan.

The AidData report lists 72 Indonesian BRI projects amounting to a total of $21 billion. It says nine of those, worth $5.2 billion, have been tainted by scandals, controversies or alleged violations. Four were linked directly to “financial wrongdoing.”

Indonesia does not do well in other areas either, with six projects worth $4.6 billion reportedly causing harm to communities or local ecosystems. The chief culprit appears to be a 700MW coal-fired power station in South Sumatra, financed by the Industrial and Commercial Bank of China (ICBC), Bank of China and the China Construction Bank.

In March last year, more than 100 construction workers went on strike to protest health and safety violations, workplace discrimination, illegal layoffs and a failure to provide overtime pay. The plant has also caused flooding and damage to a nearby palm oil plantation, according to the report. (Courtesy Asia Times)

Post a Comment